Are you there, money? It’s me, Esther. We need to have a serious talk…

I’m willing to bet that if you guessed my favorite topic to discuss, you wouldn’t guess it correctly… because it’s money, honey! This has NOT always been the case for me and most likely isn’t the case for you if you’re reading this article– and you are not alone!

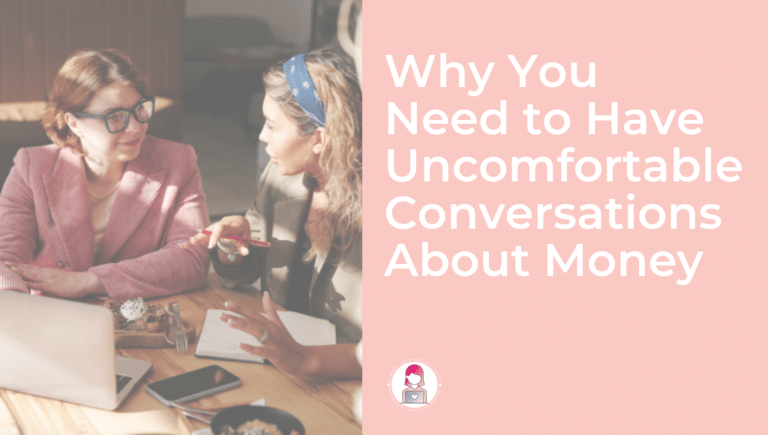

Throughout my years of experience working online and constantly leveling up in my business, I’ve had no choice but to get comfortable with being uncomfortable, especially when it comes to having conversations about money.

I’m here to tell you that you can do this too, along with the many reasons why getting up close and personal with your finances, your money story, and why you have the beliefs you do will help you to level up in your business and your life.

Why am I afraid of having uncomfortable conversations about money?

When it comes to talking about money, most people would do just about anything to avoid the topic because it brings up so much fear and anxiety, especially in women. We are so afraid to discuss our finances, ask for a raise, or deal with our overwhelming debt that just the thought of it just makes us want to puke. I’ve been there!

We have it programmed in our minds that dealing with money is scary and hard so we do absolutely everything to avoid learning about it, dealing with it, talking about it, or facing it. I’ve had to deal with my fears of money head-on by affirming that dealing with money can be tough, but that I am more than capable of handling it and so are YOU!

We’ll do extra work that we should be paid for, we won’t ask for what we think we deserve, and we won’t charge enough for our services… Enough is enough!

The truth is that the more you can embrace the money, the more money you are going to make.

Money is such a taboo topic in our culture; everyone wants more money, but nobody wants to have the uncomfortable conversations that need to happen to get more money.

Many of our money beliefs were passed down from generation to generation, modeled to us by our parents in childhood, and often aren’t true. It’s important for us to have this knowledge as we uncover what beliefs and fears are holding us back from having these uncomfortable conversations about money.

Why do I need to have these uncomfortable conversations about money?

I want you to understand the fact that in order to be a successful online worker, you need to embrace the financial part of being an entrepreneur.

You must advocate for yourself as your own boss. This means that there will be times where you need to handle difficult conversations around money because you deserve to be paid for what you are worth– but first you’ve gotta ask!

I’ve dealt with this with my own team members who are filled with anxiety over discussing money and have agonized over coming to me to ask about a raise that they have absolutely earned. You are definitely not alone in the discomfort, but it’s time that we all embrace the fear with open arms.

Moving through the icky feeling we all get around having uncomfortable conversations about money is worth it in the end because you are showing yourself that you are stronger than those uncomfortable feelings. You will do what it takes to get the money you deserve as a successful online worker.

If you are a contract worker or service provider online, YOU are in control!

You decide when to charge more, who you work with, and when you want to work, which is AMAZING… but with this independence and freedom comes more responsibility.

I didn’t make it to $1 million by never looking at my bank account, not reading financial books, not hiring a bookkeeper, and not having really uncomfortable conversations about money.

Before I could implement these game-changing strategies in my business, the first thing I had to do was take a serious look at my past and most importantly, my money story.

I realized that I had to change my money story to reflect not who I was, but who I wanted to be.

Why is my money story holding me back?

Your money story includes your thoughts, beliefs, and feelings around money, along with your collection of experiences and memories with money that come together to form it.

Finally getting in touch with my money story and getting clear on what limiting beliefs were holding me back absolutely changed the trajectory of my family’s financial future beyond what I ever thought was possible.

In the past, my family has been on food stamps with negative money in our bank accounts, a difficult part of my life that I’ve had to own as part of my money story.

I can remember being in line at the grocery store and having to put back toiletries that my family desperately needed because we couldn’t afford them. This is an embarrassing and traumatic memory for me and a serious part of my money story that I’ve had to work through.

These past traumas were affecting my thoughts and feelings about money in the present moment, leaving me feeling overwhelmed and like the possibility of homelessness was always just around the corner. These beliefs were holding me back from reaching towards a better future for my family.

Now, I’ve turned the corner with a new story of empowerment, so that when my mind starts to panic, I talk back to it with affirmations of positivity around handling my finances.

I recently enrolled in an investment class to learn more about investments and how to make my money work for me. I’ve had to repeat positive affirmations to help calm myself during these challenging classes when my old, limiting beliefs around money start to pop up in my head.

Here are some of the affirmations I love to use:

- I can do this

- I can learn new things

- My past money story does not have to define my future

- I’m going to embrace difficult conversations knowing that the end result is going to be what is best for me

These affirmations are all TRUE– yes, even for you too!

I filled my brain with these new, positive affirmations that told me that I can change my relationship with money by facing the fears and dealing with them head-on; no more hiding! You will be so much better off if you can remove the fear of dealing with your finances as a successful online worker! It’s just a part of it and it doesn’t have to be so scary.

How do I get started with changing my money story?

In my virtual assistant training and online job support program, 90 Day VA, I include a series of training videos on mindset work for my students because mastering your mindset is everything as an online worker.

The mindset series guides them in visualizing their ideal future and working through the limiting beliefs that are holding them back from creating their dream job and lifestyle as virtual assistants.

As a virtual assistant, you are your own boss and your biggest cheerleader so if you don’t fully believe in yourself, nobody else will.

I highly recommend you take a look at your own money story and examine what past experiences and beliefs might be holding you back.

If you can start by being aware of what money beliefs your parents passed down to you and which experiences with money have shaped you, you can then accept these experiences and change your beliefs, using any past struggles as fuel to create a brighter financial future.

I have an entire series on my podcast all about money and empowering you with your finances and an episode diving much deeper into my money story and how my mindset helped me get to where I am today.

So, are you ready to look at the pieces of your money story that are triggering you whenever money topics come up? Rewrite it from the point of view of an empowered person who has grown from their past and is ready for a new future.

Becoming a VA was my first step in the long journey of becoming financially secure and confident, and I want to share that feeling with everyone.

If you’re feeling ready to start a new money story and take control of your financial future, my FREE MASTERCLASS gives you all the details on what being a VA is all about and how you can become one too!

In 90 Day VA, Esther teaches her students how to research and repurpose current content into blogs for the VAI website. Kaitrin is the student we’ve chosen this week to feature what she’s learned in the course. Get to know her:

Kaitrin Freeman is a virtual assistant here to help her clients not sweat the small stuff. When she’s not busy helping entrepreneurs level up in their business, she loves to go hiking and dancing. She’s a member of 90 Day VA and assists with everything from social media, calendar and e-mail management to blog writing. To see all the services she offers and how she can help you, check out her website here: https://www.facebook.com/kaitrinfreeman/